Stocks fell on Monday as traders booked some profits given the historically strong gains logged in November.

The Dow Jones Industrial Average dropped 271.73 points, or 0.9%, to close at 29,638.64. Earlier in the day, the Dow was down by more than 400 points. The S&P 500 slid 0.5% to 3,621.63, and the Nasdaq Composite closed lower by 0.1% at 12,198.74.

Travelers and Chevron were among the worst-performing Dow stocks, falling 3.6% and 4.5%, respectively. Energy led the way lower in the S&P 500, losing 5.4% for its worst day since June 24.

Cruise lines and airlines, two of the best-performing groups this month, struggled on Monday. Carnival dipped 7.4%, and Norwegian Cruise Line slid 3.4%. American Airlines dropped more than 5%, and Delta pulled back by 2%.

Despite Monday's losses, the major averages posted sharp monthly gains.

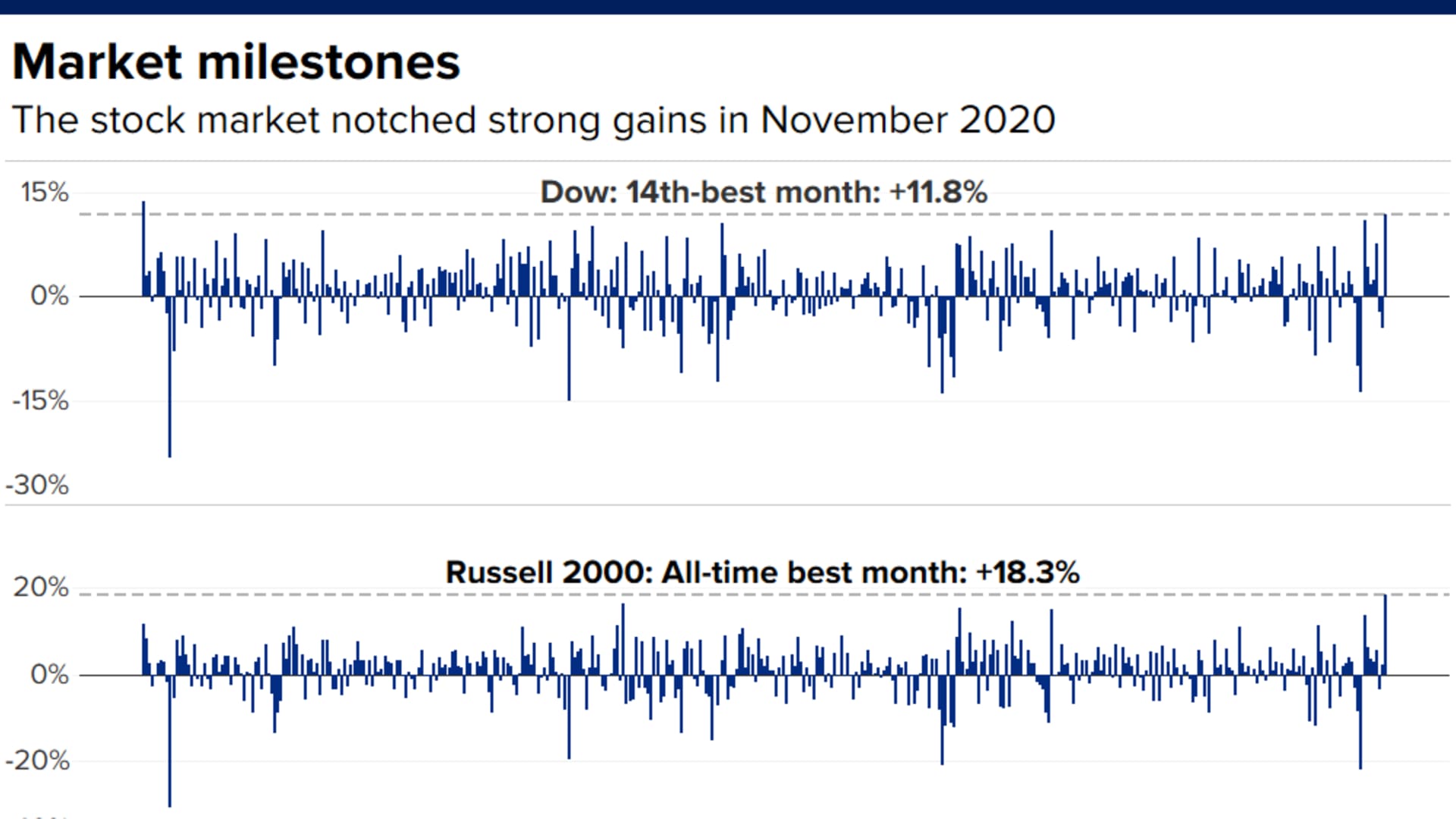

The blue-chip Dow rose 11.8% in November, its best monthly performance since January 1987, as promising vaccine developments boosted confidence of a smooth economic reopening. The S&P 500 and the Nasdaq climbed 10.8% and 11.8%, respectively, in November, their biggest monthly advances since April.

"The length and strength of the current rally suggests to us that the market could be vulnerable to some pullback at these levels," wrote John Stoltzfus, chief investment strategist at Oppenheimer Asset Management. "That said, the bull market that has emerged from the lows on March 23rd of this year has shown similarities to its predecessor ... in having a predilection to climb walls of worry aided and abetted by monetary policy and secular trends deeply embedded in technology and globalization."

Money Report

Small caps were on a tear this month as investors piled into beaten-down value names. The Russell 2000 rallied more than 18% in November, its best month ever.

Cyclical sectors, those most economically sensitive groups, led the market's November rally amid a slew of positive vaccine news. Energy, 2020's biggest loser, jumped 26.6% this month, while financials, industrials and materials all gained at least 12.2% during this period.

Boeing and American Express led the way higher for the Dow, rising 45.9% and 30%, respectively, in November. Chevron, JPMorgan Chase, Disney and Honeywell each rose more than 20% this month.

November's gains came even as the number of coronavirus cases continued to rise in the U.S.

More than 266,000 people have died from the coronavirus in the U.S., and more than 13 million cases have been confirmed in the country, according to data from Johns Hopkins University. Dr. Anthony Fauci, the nation's top infectious disease expert, said on Sunday that the U.S. is heading into a tough period of the pandemic in which restrictions and travel advisories will be necessary.

Los Angeles County in California imposed a new stay-home order Friday as cases surged in the nation's most populous county. Meanwhile, New York City public schools will begin to reopen on Dec. 7.

"This rally has been notable as the rotation from Growth to Value has continued to gain momentum despite the negative news flow of Covid cases surging around the country and lockdowns again being imposed in various parts of the nation," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance.

However, Moderna said Monday that new trial data showed its Covid-19 vaccine candidate was more than 94% effective. The company added it plans to ask the Food and Drug Administration for emergency clearance later in the day. Moderna shares rallied 20.2%.

The market was coming off a record-setting holiday week that saw the 30-stock Dow surge past the 30,000 milestone for the first time. The S&P 500 and the Nasdaq both closed Friday at fresh record highs.

Market sentiment took a hit after Reuters reported that the Trump administration is weighing blacklisting Chinese leading chipmaker SMIC as well as national offshore oil and gas producer CNOOC. The move would limit their access to American investors and escalate tensions with China before President-elect Joe Biden takes over.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.