Tesla's trek higher continues.

Shares of the electric-auto maker surged Thursday after Goldman Sachs upped its rating on the stock to buy from neutral, citing accelerating electric vehicle adoption. The firm also raised its price target on the stock to $780, one of the highest on the Street.

Tesla's stock closed up more than 4% following the call at $593.38 a share.

Though that brings Tesla's year-to-date gain to more than 600%, Goldman's price target is still "very achievable" on a longer-term basis, Matt Maley, chief market strategist at Miller Tabak, told CNBC's "Trading Nation" on Thursday.

"I think you want to continue to ride the wave right now," he said. "On a short-term basis, it still looks good."

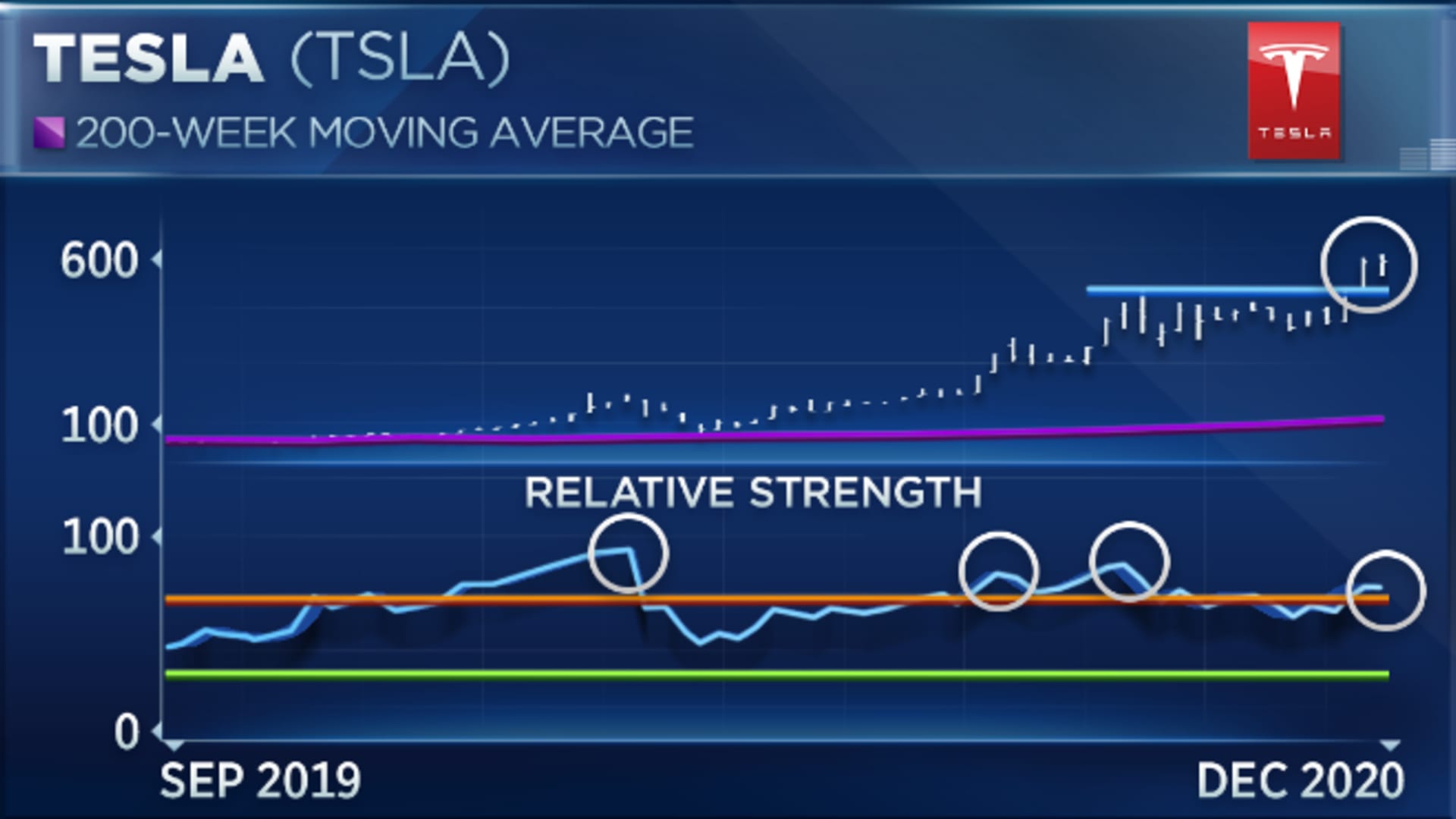

Maley added that while Tesla looks overbought on paper with its weekly relative strength index above 70, in the last two years, its RSI has had to rise above 80 to cause a major decline in the stock.

Money Report

"Even though it's [overbought] for most stocks, it's … not overbought for Tesla," he said. "You want to let this thing ride and I think it easily can get to 650 if not 700 over the next month or two. But … we also see that every time it does get that extreme, above 80 on its weekly RSI, it sees a big pullback — 25% or more."

That means there's a risk of the stock falling as low as $500, Maley said — but that didn't stop him from recommending riding the wave.

"For those that want to be a little bit more active in the name, take profits on maybe half your position sometime in the first quarter as it gets overbought and look to buy it back at a lower level for that big, long-term kicker," he said. "Because I think this stock is going to continue to be a very volatile one even though it's moving into the S&P 500."

Even with all the hype, Tesla does have real potential to keep climbing, Delano Saporu, founder and financial advisor at New Street Advisors Group, said in the same "Trading Nation" interview.

"I do believe it can push higher, especially in the longer term," he said. "If you're a long-term investor and someone that knows and sees the valuation framework that this should be valued at, then it's possibly a good time."

Three things about Tesla stood out to Saporu: its role in the growing electric vehicle market, its execution and its cost-cutting battery technology.

"There's so much upside to look for, but it's something you have to be very careful on if you're an investor and make sure that it fits your horizon and fits your objectives," Saporu said.