-

Bronx tax preparer known as ‘the Magician' charged by IRS in $100 million fraud

A Bronx tax preparer known as “the Magician” was arrested by IRS Criminal Investigations agents in an alleged $100 million dollar tax rip-off scheme.

-

Bronx tax preparer charged for allegedly filing thousands of false tax returns in $100M scheme

Prosecutors said Rafael Alvarez filed tens of thousands of false tax returns causing over $100 million in tax loss. The IRS claims he was allegedly so prolific that he became known as “The Magician” for his ability to make customers’ tax burdens disappear.

-

IRS targets wealthy ‘non-filers' with new wave of compliance letters

The IRS on Thursday unveiled plans to target wealthy “non-filers” with a new round of compliance letters. Here’s what taxpayers need to know.

-

From Taylor Swift to CEOs, the IRS to crackdown on private and corporate jet users

First, there were trackers on Taylor Swift and other celebrities’ private jet usage. Now, there will be more scrutiny on executives’ personal use of business aircraft who write it off as a tax expense.

-

Servicios gratuitos de preparación de impuestos en NYC

Esto es lo que puede esperar al acudir a una de las sucursales gratuitas de preparación de impuestos que se encuentran en la ciudad. Te contamos las calificaciones.

-

IRS testing free direct file pilot program for New York filers

The IRS is launching a pilot program for certain taxpayers to fill out your return directly for free on the agency’s website.

-

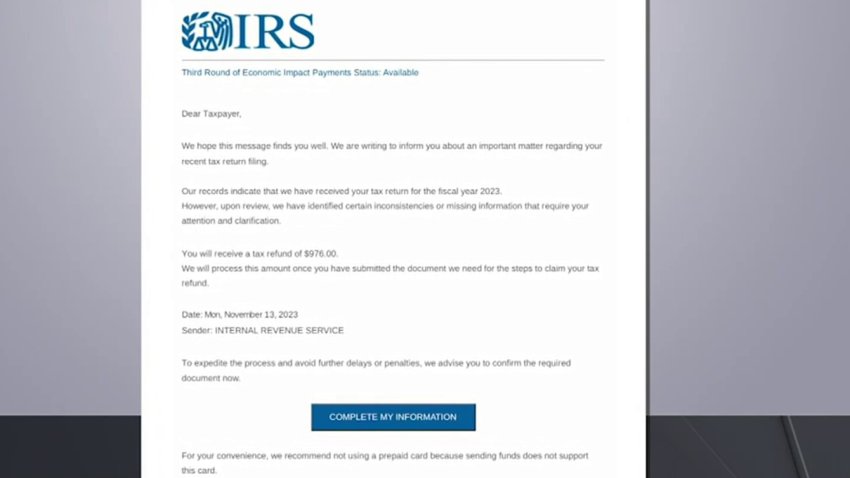

IRS warns about new email scam ahead of tax season

With tax season about to get underway, the IRS is warning about a new scam targeting people though email. NBC New York’s Lynda Baquero has what you need to know to avoid becoming a victim.

-

IRS warns of new email scam ahead of 2024 tax filing season: What to know

The official start to the 2024 tax filing season is just a few days away, and the IRS has a warning about scams that could cost victims big money.

-

What is Direct File, the new IRS tool to file your taxes

Direct File is a new filing tool by the IRS that allows taxpayers of any income to file their taxes for free.

-

Tax season kicks off Jan. 29: What you need to know

Here are all the important dates you’ll want to know for tax season this year.

-

IRS delays tax reporting rule for users of payment apps like Venmo, Cash App

Users of Venmo, Cash App and other payment apps will get a tax reprieve this year. The IRS announced Tuesday it will delay implementing new reporting requirements that were to take effect for the coming tax filing season.

-

Hunter Biden sues IRS over handling of his private records

President Joe Biden’s son, Hunter Biden, sued the IRS on Monday, alleging that the agency illegally released his private tax records.

-

Hunter Biden sues the IRS over tax disclosures after agent testimony

The lawsuit filed Monday says that his personal tax details shared during congressional hearings and interviews was not allowed by federal whistleblower protections.

-

IRS unveils ‘paperless processing initiative' for taxpayers. Here's what to expect

The IRS will offer digital correspondence for the 2024 season and aims to provide “paperless processing” for tax returns in 2025. Here’s what to know.

-

IRS halts most unannounced visits to taxpayers, citing safety concerns

The IRS has ended most unannounced visits to homes or businesses for unpaid taxes. Here’s what taxpayers need to know.

-

IRS says it collected $38 million from more than 175 high-income tax delinquents

The IRS is showcasing its new capability to aggressively audit high-income tax dodgers as it makes the case for sustained funding and tries to avoid budget cuts sought by Republicans who want to gut the agency. IRS leaders have laid out how they netted $38 million in delinquent taxes from more than 175 high-income taxpayers in the past few months....

-

IRS warns of new ‘unclaimed refund' scam through the mail

The IRS is warning taxpayers about a new scam tricking people into believing they are owed a refund.

-

IRS Moves Forward With Free E-Filing System in Pilot Program to Launch in 2024

The IRS is planning to launch a pilot program for a government-run, online tax filing system that’s free for all.

-

Haven't Filed Taxes Yet? Don't Panic. Here's What to Know

The deadline to file your taxes is fast approaching. If you are worried that you might not have enough time to file your taxes before the deadline, you can file for an extension.

-

¿Necesitas más tiempo para declarar tus impuestos? Así puedes pedir una extensión

Hablamos con el IRS sobre cómo pedir una extensión de la fecha límite para presentar la planilla de impuestos. Una extensión es para presentar, no para pagar. Si debe pagar impuestos debe hacer ese pago antes del 18 de abril.