Here are the most important news, trends and analysis that investors need to start their trading day:

- Stocks set to pop on strong earnings reports

- Covid stimulus checks could really boost retail sales

- BofA tops estimates on strong investment banking

- Coinbase set to jump after strong but volatile debut

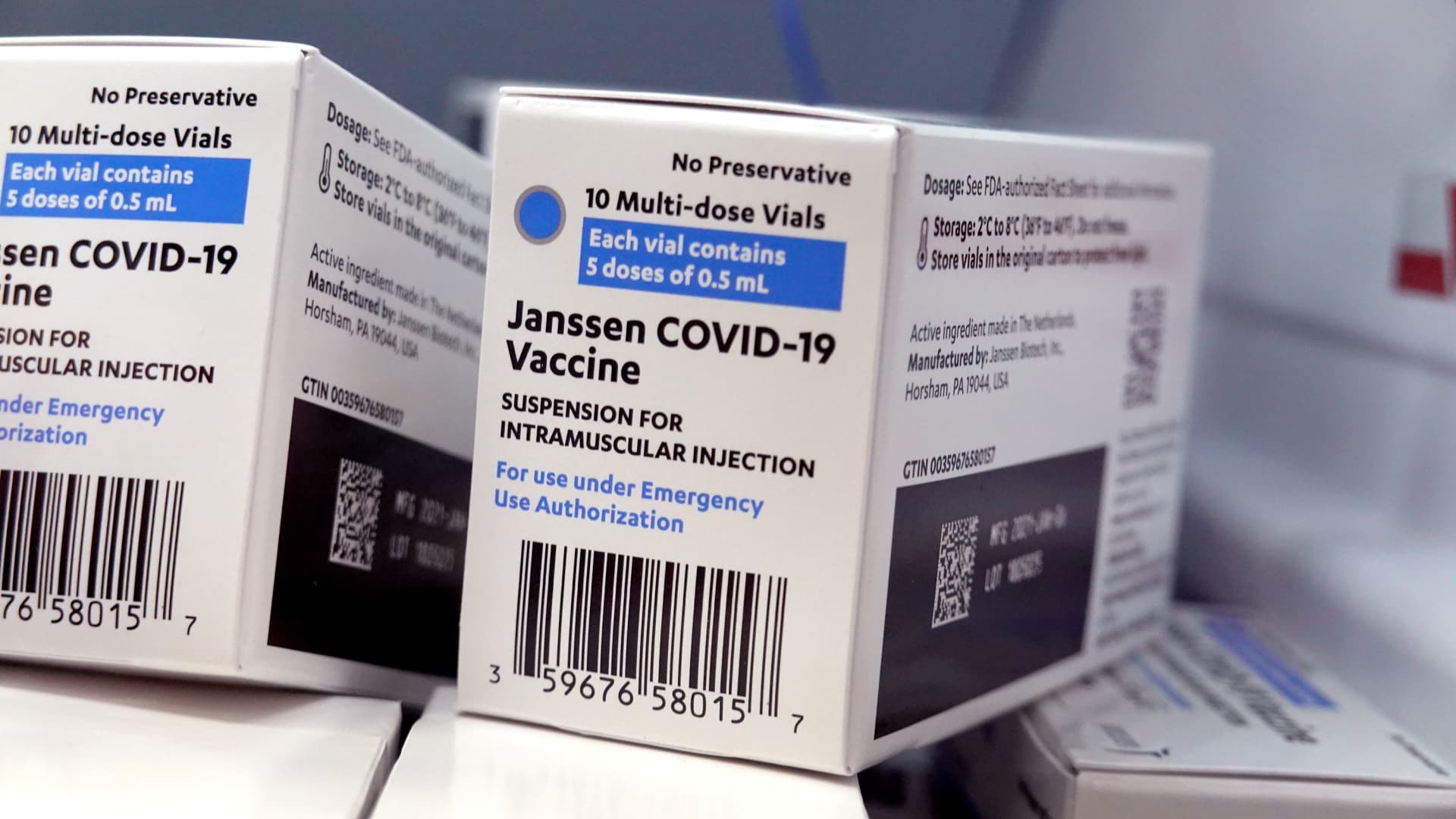

- CDC panel delays decision on J&J Covid vaccine pause

1. Stocks set to pop on strong earnings reports

Get Tri-state area news and weather forecasts to your inbox. Sign up for NBC New York newsletters.

U.S. stock futures rose Thursday after better-than-expected earnings results and as Treasury yields drifted lower even after strong economic data.

- Bank of America shares rose as earnings in the first quarter blew past expectations on booming trading and investment banking. Citigroup saw much of the same.

- PepsiCo stock gained ground after the consumer snack and drink maker said sales last quarter rose nearly 7%, topping estimates.

- Shares of UnitedHealth, a Dow component, advanced after results topped estimates, and the health insurer raised guidance for 2021.

- Delta shares gained after the airline posted a nearly $1.2 billion quarterly loss but said it expects to break even in June as bookings improve.

On Wednesday, the S&P 500 slipped from record levels in volatile trading as tech shares declined. The Nasdaq lost 1%. The Dow Jones Industrial Average bucked the trend, posting a modest gain.

Money Report

The 10-year Treasury yield dipped below 1.6% on Thursday morning.

2. Covid stimulus checks could really boost retail sales

The Commerce Department on Thursday reported March retail sales soared 9.8%, well above estimates for a 6.1% increase. A fresh batch of Covid stimulus checks sent consumer purchases surging last month as the U.S. economy continued to get support from aggressive congressional spending. February's retail sales were upwardly revised a bit to a drop of 2.7%.

The Labor Department on Thursday reported 576,000 initial jobless claims last week, much lower than expectations for 710,000 new filings. That was easily the lowest since the early days of the pandemic and represented a sharp decline from the previous week's upwardly revised 769,000 total.

3. BofA tops estimates on strong investment banking

Bank of America's earnings topped estimates on strong investment banking and trading results, as well as the release of loan-loss reserves as fewer consumers were expected to default on loans. Like other banking rivals, BofA saw a large benefit from the improving U.S. economic outlook in recent months.

Citigroup's results that beat analyst estimates for first-quarter profit with strong investment banking revenue and a bigger-than-expected release of loan-loss reserves. The firm also said it's shuttering retail banking operations in 13 countries across Asia and parts of Europe to focus more on wealth management outside the U.S.

4. Coinbase set to jump after strong but volatile debut

Coinbase Global shares jumped another 8% in Thursday's premarket, one day after the cryptocurrency exchange debuted with a nearly $86 billion market value. Nasdaq provided a reference price late Tuesday of $250 per share for Coinbase's direct listing. In a volatile session, the stock opened at $381 and quickly shot up as high as $429, exceeding a $100 billion market cap. It dropped back below the debut price at one stage and reached a low of around $310. It closed at $328. Coinbase hit the public market as a record amount of cash pours into bitcoin and cryptocurrencies.

5. CDC panel delays decision on J&J Covid vaccine pause

The CDC's Advisory Committee on Immunization Practices has decided to postpone a decision on Johnson & Johnson's Covid-19 vaccine while it investigates cases of six women developing a rare but severe blood clotting disorder that left one dead and another in critical condition. The panel met on Wednesday, a day after the FDA asked states to temporarily halt using the J&J's vaccine "out of an abundance of caution." The panel's postponement means the pause on J&J's vaccine remains in effect. The CDC committee voted unanimously to reconvene in a week.

— Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus blog.