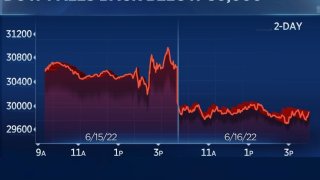

The Dow Jones Industrial Average on Thursday tumbled below the key 30,000 level for the first time since January 2021 as investors worried the Federal Reserve's aggressive approach toward curbing inflation would bring the economy into a recession.

Markets had rallied on Wednesday after the Fed announced its largest rate hike since 1994, but reversed those gains and then some on Thursday.

Get Tri-state area news and weather forecasts to your inbox. Sign up for NBC New York newsletters.

The Dow dropped 2.42%, or 741.46 points, to 29,927.07, while the S&P 500 slipped 3.25% to 3,666.77. The Nasdaq Composite slid 4.08% to 10,646.10 and touched its lowest level since September 2020.

The major averages have suffered steep losses this week. The S&P 500 is down 6%, while the Nasdaq has fallen 6.1%. The blue-chip Dow is off by 4.7% this week and on pace for its 11th losing week of the last 12.

The S&P 500 and Nasdaq Composite fell further into bear market territory, ending the session down roughly 24% and 34% from their all-time highs, respectively, as inflation and fears of slowing economic growth weigh on investors. The Dow, meanwhile, is 19% below its Jan. 5 all-time intraday high.

Money Report

"Investor sentiment seems to only be able to focus on one thing at a time," said Susan Schmidt of Aviva Investors. "Yesterday, the Fed delivered as people expected. It was combating the consumer price index data that was much higher than people expected and raised concerns about inflation being so aggressive. Investors are now remembering that the counter to this is a slowing of the economy."

Thursday marked the first time the Dow has traded below 30,000 since January 2021. The average first moved above that level in November 2020 when massive monetary and fiscal stimulus fueled a broader market rally — led by tech shares — and took the major averages to then-record highs.

Breaking above the 30,000 mark put the Dow more than 60% above its pandemic closing low at the time. While 30,000 isn't necessarily a technical level for the Dow, these round 1,000-point thresholds are seen by many on Wall Street as key psychological levels for the market.

Data out Thursday further indicated a dramatic slowdown in economic activity. Housing starts dropped 14% in May, much deeper than the 2.6% decline expected by economists polled by Dow Jones. The Philadelphia Fed Business Index for June came in with a negative 3.3 reading, its first contraction since May 2020.

Home Depot, Intel, Walgreens, JPMorgan, 3M, and American Express hit new 52-week lows amid growing recession fears while tech shares dropped after a bounce on Wednesday. Amazon, Apple and Netflix all sank nearly 4%. Tesla and Nvidia dropped 8.5% and 4.6%, respectively.

Travel stocks also took a leg lower on Thursday. United and Delta tumbled 7.5% and 8.2%, respectively, while cruise line stocks Carnival, Norwegian Cruise Line and Royal Caribbean plummeted 11%. All major sectors declined on Thursday, led by consumer discretionary and energy, down about 5% each. Just four Dow stocks closed higher on the day.

Staples stocks, known for their steady cash flows that could hold up during recessions, traded into the green or near the flatline. Procter & Gamble, Colgate-Palmolive and Walmart were slightly higher.

"The Fed has a very tight needle to thread here and I think investors and the market, in general, are losing a good deal of confidence that the Fed might be able to do that," said Ryan Detrick, chief market strategist at LPL Financial. "The truth is, the Fed is probably behind the eight ball. They should have been hiking more aggressively — probably starting late last year looking back — and the market is realizing that."

Allianz's chief investment advisor Mohamed El-Erian echoed a similar sentiment during an interview with "Squawk Box" on Thursday, where he said central banks globally are behind on fighting inflation and undergoing "a great awakening."

"It's about time we exit this artificial world of predictable massive liquidity injections where everybody gets used to zero interest rates, where we do silly things whether it's investing in parts of the market we shouldn't be investing in or investing in the economy in ways that don't make sense," he said. "We are exiting that regime and it's going to be bumpy."

Markets on Wednesday initially liked the Fed's plan to hike interest rates by 75 basis points and the potential of additional hikes of a similar magnitude. The Dow and S&P 500 on Wednesday snapped a five-day losing streak and ended the session higher.

Market sentiment appeared to sour once again Thursday as central banks around the globe adopted more aggressive policy stances and investors questioned whether the Fed can pull off a soft landing.

The Swiss National Bank overnight raised rates for the first time in 15 years. The Bank of England was set on Thursday to raise rates for the fifth straight time.

As stocks fell, the 10-year Treasury yield slipped on Thursday and was last trading around 3.24%. The benchmark rate notched an 11-year high above 3.48% earlier in the week.