Stocks were higher Tuesday following a broad-based rally on news that U.S. regulators granted full approval for Pfizer-BioNTech’s Covid vaccine.

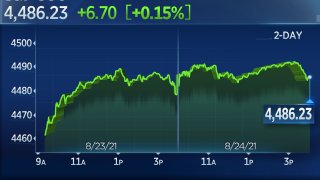

The Dow Jones Industrial Average rose 30.55 points, or less than 0.1%, to 35,366.26. The S&P 500 added 0.1% to a new closing high of 4,486.23. The Nasdaq Composite gained 0.5% to 15,019.80, also a new closing high.

Chinese stocks led the Nasdaq as investors have been getting more clarity on China's regulatory outlook and buying shares of names that have taken a beating lately. Pinduoduo jumped 22.2% while JD.com rose 14.4%, Tencent Music Entertainment climbed 12.7% and Baidu gained 8.6%.

Get Tri-state area news and weather forecasts to your inbox. Sign up for NBC New York newsletters.

"There is follow through on dip buying in Chinese tech after several firms reiterated buys on the stocks, but the jury is still out on whether there's more pain to come on further government crackdowns in this sector," said Jamie Cox, managing partner for Harris Financial Group.

On Tuesday afternoon, Gary Gensler, chairman of the U.S. Securities and Exchange Commission, said the agency will demand U.S.-traded Chinese companies disclose political and regulatory risks to investors, an extension of recently imposed requirements for firms seeking initial public offerings, according to a Bloomberg report. Corporations could begin including the enhanced disclosures in their annual reports as early as next year, Bloomberg found.

Shares of vaccine makers pulled back Tuesday. Pfizer and BioNTech were more than 3% lower. Moderna fell 4.1% and Trillium Therapeutics, which surged about 180% in the prior session on news it would be acquired by Pfizer, closed 0.6% lower on Tuesday.

Money Report

Travel stocks extended their rally from Monday, with several airline and cruise stocks rising Tuesday. Casino operators Las Vegas Sands and Wynn Resorts were also higher by about 7%, after Macau eased travel restrictions with the improvement of the Covid-19 case outlook in China's Guangdong province, a key visitor source for the gambling capital.

"Markets seem to believe that the latest Covid flare up has peaked, and that's a good thing," Cox said. "Even though some airport data suggest traffic is rolling over a bit, any change to the trajectory of the delta variant will have that data rocketing back."

Best Buy shares rose 8.3% after the electronics retailer beat estimates on the top and bottom lines for the second quarter.

The second-quarter earnings season is winding down with more than 90% S&P 500 companies having reported results. S&P 500 is poised to grow its earnings by 94.7% year over year, according to Refinitiv.

The markets were relatively quiet as investors await the Jackson Hole symposium later this week. Meme stocks surged in the late afternoon, however, with GameStop rallying by 27.5% and AMC jumping 20.3%.

Investors are eyeing the Federal Reserve's annual central banking event in Jackson Hole, Wyo. later this week, focused on whether or not central bankers will detail their plans for tapering monetary stimulus. The Fed has started discussions to pull back its $120 billion a month bond-buying program by the end of this year.

The summit will take place virtually on Thursday, and Fed Chairman Jerome Powell will give a speech on Friday.

"The Fed may make a taper announcement in September or November, but it will probably be a slow taper with no commitment over interest rate hikes," said Edward Moya, senior market analyst at Oanda.