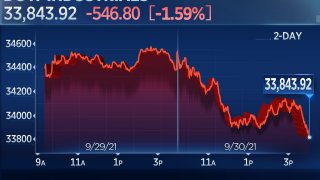

U.S. stocks pulled back on Thursday as Wall Street wrapped up its worst month of the year on a sour note.

The Dow Jones Industrial Average dropped 546.80 points, or 1.59%, to close at 33,843.92. The broader S&P 500 was down 1.19% to 4,307.54, while the tech-heavy Nasdaq Composite fell 0.4% to 14,448.58.

The weakness for the market came on the final day of what has been a rough month for equities, as rising rates, inflation fears and concerns about the Chinese property market have roiled stocks. The S&P 500 finished September down 4.8% for its worst month since March 2020, when the pandemic caused a major market sell-off. The index also closed 5% below its record high for the first time this year.

Get Tri-state area news and weather forecasts to your inbox. Sign up for NBC New York newsletters.

The Nasdaq fell 5.3% for its worst month since March 2020, while the Dow dropped 4.3% for its worst month in 2021.

"September lived up to its reputation and dented stock portfolio returns, but not too badly," wrote Ed Yardeni of Yardeni Research. "There has been a lot of concern that higher wages, higher energy prices, and higher transportation costs will weigh on earnings for the remainder of this year and into 2022. It's certainly something we'll be tracking. But so far, analysts remain relatively sanguine."

Concerns about inflation and supply chain issues continued to hamper the markets on Thursday. Shares of Bed Bath & Beyond fell 22.1% after the company said those issues hurt the company's second-quarter results, and the news appeared to hit fellow retail stocks. Walgreens Boots Alliance and Home Depot fell 3.4% and nearly 2.6%, respectively, making them two of the worst performers in the Dow.

Money Report

Energy and financial stocks, which have been some of the best performers in recent weeks, took a step back on Thursday. Shares of Goldman Sachs were 1.7% lower, while JPMorgan was down 1.3%.

Tech stocks outperformed on Thursday, but the Nasdaq still suffered its fifth-straight losing session. Tech names have been hit by the recent jump in the 10-year Treasury yield, which broke above 1.567% earlier in the week. The measure retreated slightly on Thursday.

Rising yields, fueled by concerns over inflation and the Federal Reserve's signals that it will soon begin winding down its pandemic-era asset purchases, are seen as a negative for tech stocks because they make far-off future profits look less attractive to investors.

"We've been talking about spooky season — September and October — and the expectation of about a 5% dip from the high. … But we've said we don't expect a correction," said David Bianco of DWS Group. A correction is typically defined as a pullback of more than 10% from a recent high.

"We expect yields to climb, and that's why we're overweight banks, but we don't expect yields to surge. And without a surge in yields, we can live with these [valuations]," Bianco added.

Shares of Apple and Amazon finished the day in negative territory after moving higher in morning trading. Chip giant Nvidia and Netflix managed to hold on to their gains but closed well off session highs.

"We wouldn't get caught up in any end-of-quarter machinations today and continue to advise fading rallies (especially in tech) as the coming weeks will stay rocky," wrote Adam Crisafulli of Vital Knowledge.

September's losses led to a weak third quarter for the market. For the 3-month period, the Dow dropped 1.9%, while the Nasdaq Composite shed 0.4%. The S&P 500 held on to a modest gain and is still up nearly 15% on the year.

October has a reputation for some violent sell-offs but overall is typically the start of better seasonal performance for stocks. The S&P 500 averages a 0.8% gain for the month, according to the Stock Trader's Almanac.

Investors were also keeping an eye on Washington as Congress passed a bill that would fund the government through early December. The bill would avert a government shutdown but Congress still has not raised the debt ceiling, which Treasury Secretary Janet Yellen says will be reached on Oct. 18.

Yellen and Fed Chair Jerome Powell testified before the House Financial Services Committee on Thursday. Yellen reiterated her call for Congress to raise the debt ceiling, saying that failure to do so would be "catastrophic."

On the data front, initial jobless claims for the prior week came in at 362,000. Economists were expecting a print of 335,000, according to Dow Jones. The October jobs report, which is seen as a key indicator for the Federal Reserve's next steps, will be released on Oct. 8.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today