Semiconductor stocks could be in for a sharp near-term pullback, one trader warns.

Analysts at Morgan Stanley said in a Thursday note that "winter is coming" for the group, writing that sell signals were accumulating as chipmakers entered the late stage of their cycle.

The technical backdrop is also beginning to flash warning signs, Miller Tabak's Matt Maley told CNBC's "Trading Nation" on Thursday.

Get Tri-state area news and weather forecasts to your inbox. Sign up for NBC New York newsletters.

"We're not quite there yet for me to raise a major yellow flag or even a red flag, but I am getting a little concerned," the firm's chief market strategist said.

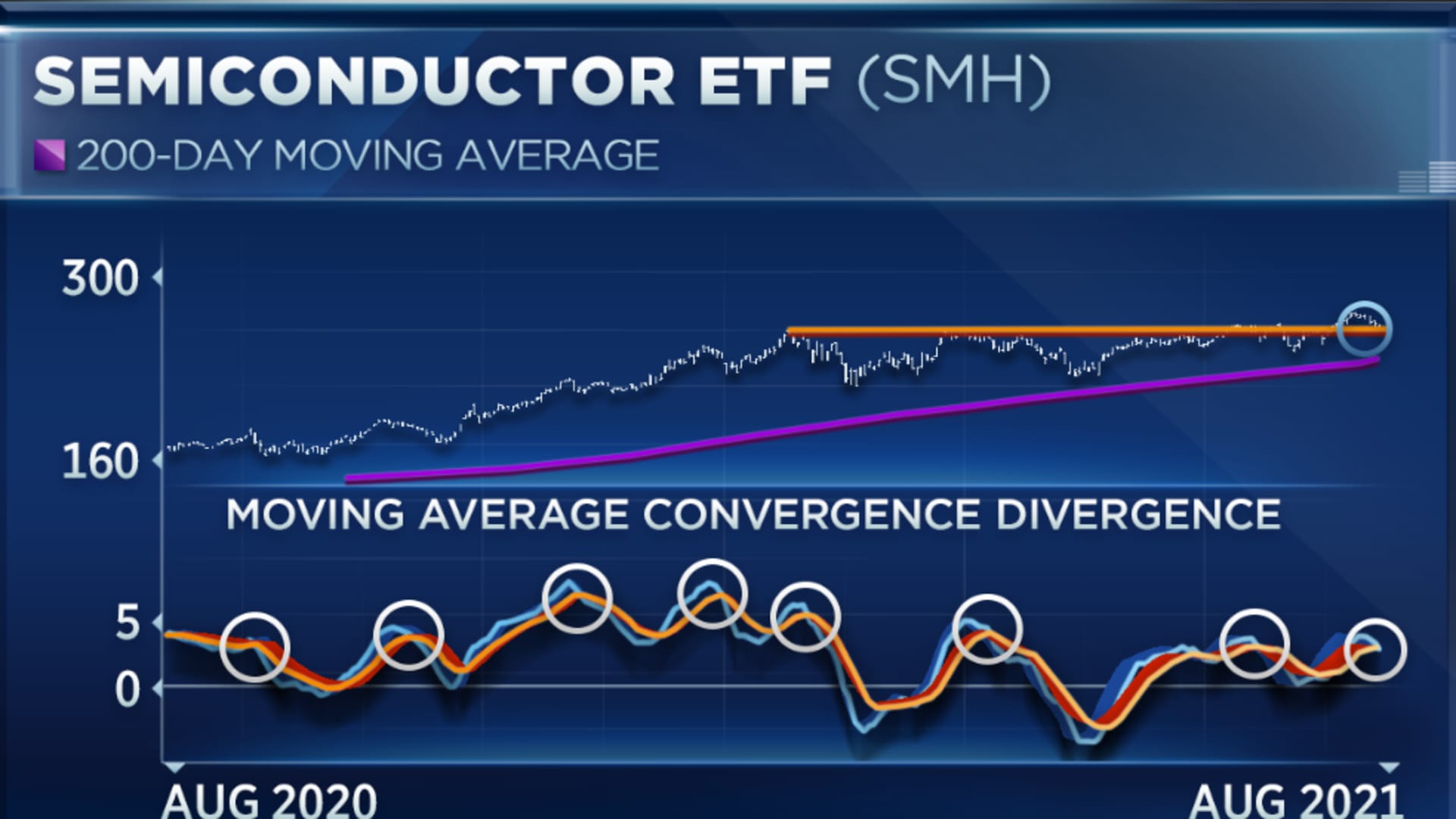

Looking at a chart of the VanEck Vectors Semiconductor ETF (SMH), Maley said the 25-stock basket was "seeing a short-term death cross" in its moving average convergence-divergence chart, a key momentum indicator.

That type of death cross has occurred eight times in the past year, "and each one of those times has been followed by a pretty decent pullback and several times, a full correction," Maley said.

Money Report

"We're starting to see that now. So, that has me concerned," he said.

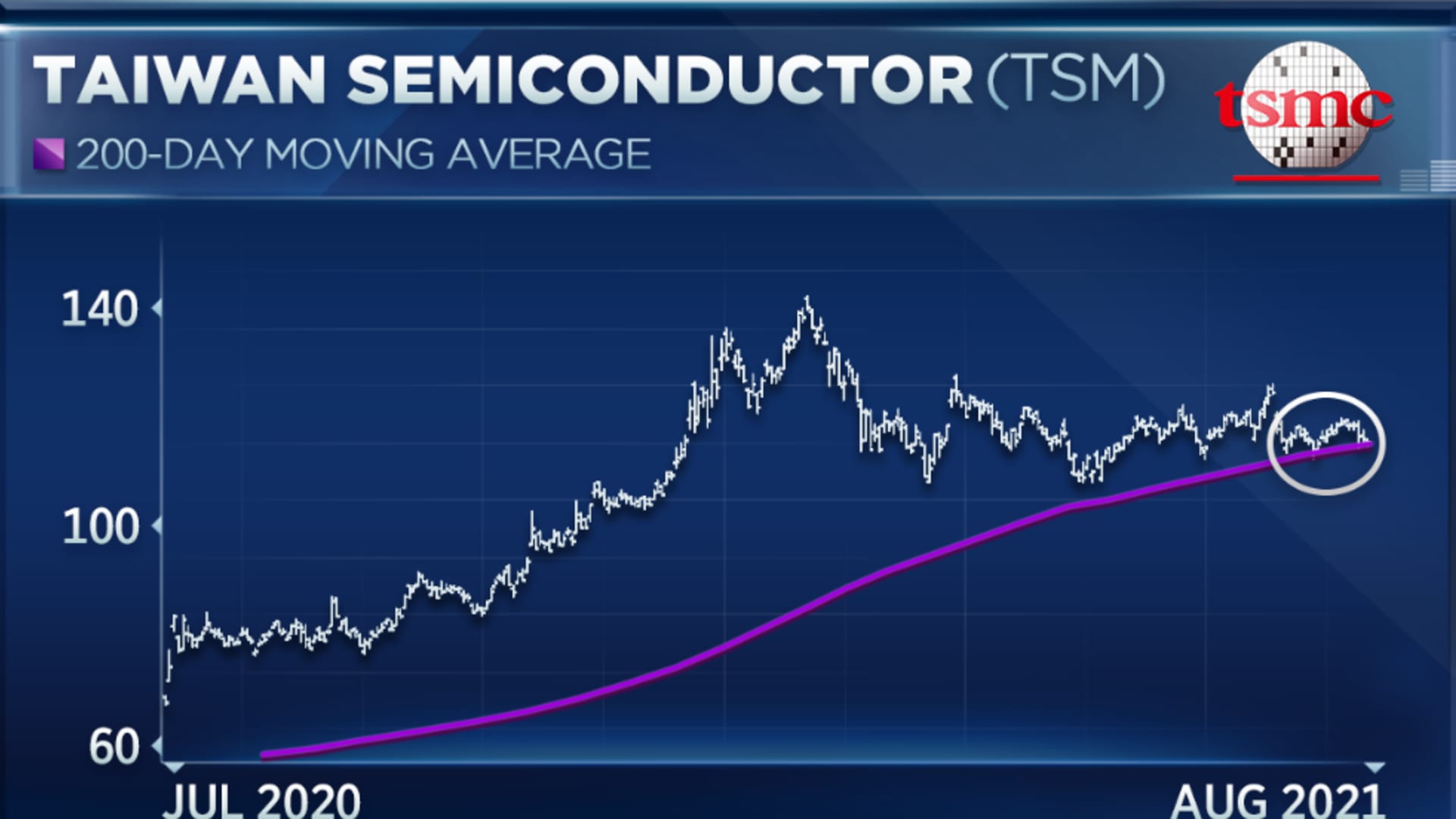

With the SMH itself now stuck in a relatively narrow trading range, Maley focused in on the chart of Taiwan Semiconductor, its top holding and the world's largest chip manufacturer.

The stock appears to be testing its 200-day moving average, which it hasn't done in over a year, Maley said.

"It bounced off that level in July, so, that's positive, but if it fails this time and breaks below it, if Micron and these others drag it down below that [level], that's going to raise a big warning flag for the group," he said.

What was one trader's warning sign was another's buying opportunity.

"The short-term hiccups I think make an interesting buying opportunity for the long term," Tocqueville Asset Management portfolio manager John Petrides said in the same interview.

The global economy's demand for chips is "very long-term supportive for thematic investors" and is set to continue as 5G networks, machine learning and electric vehicle production expand, Petrides said.

He suggested investing via Invesco's Dynamic Semiconductors ETF (PSI), a 32-stock fund with its heaviest weightings in Advanced Micro Devices, Qualcomm, Broadcom, Texas Instruments and Intel.

"Once we get through this sort of logistical nightmare that the world has been stuck in over the past eight months or so, and we should get through it over the next six months, I think the outlook is very strong for the chip sector going forward," he said.

Disclosure: Petrides owns shares of the Invesco Dynamic Semiconductors ETF (PSI). Certain clients of Tocqueville Asset Management own shares of PSI.