Inflation was higher than expected in January, as prices for consumer goods rose by 0.6% last month, according to the Labor Department.

The consumer price index (CPI), which measures the cost of various goods and services, increased by 7.5% in the last 12 months, the largest year-on-year increase since February 1982.

The CPI was expected to rise 0.4% on a seasonally adjusted basis last month, but inflation remained steady at 0.6% — the same rate as December.

While the costs of gas and used vehicles have nearly doubled in the last year, prices for other essentials like food, shelter and clothing have been steadily rising as well. The core price index, which strips out often-volatile categories of food and energy, went up 6% year-over-year in January, eclipsing December's year-over-year increase of 5.5%.

Get Tri-state area news and weather forecasts to your inbox. Sign up for NBC New York newsletters.

"While we're hopeful prices will begin to decline in the coming months, prices at grocery stores and restaurants may take longer to adjust downward," says Jonathan Silver, CEO of Affinity Solutions, a global data firm that tracks consumer purchasing habits.

Citing supply chain issues, strong demand, labor supply and weather events, Silver thinks that "we're unlikely to see a full correction in the supply chain until later this year or even 2023."

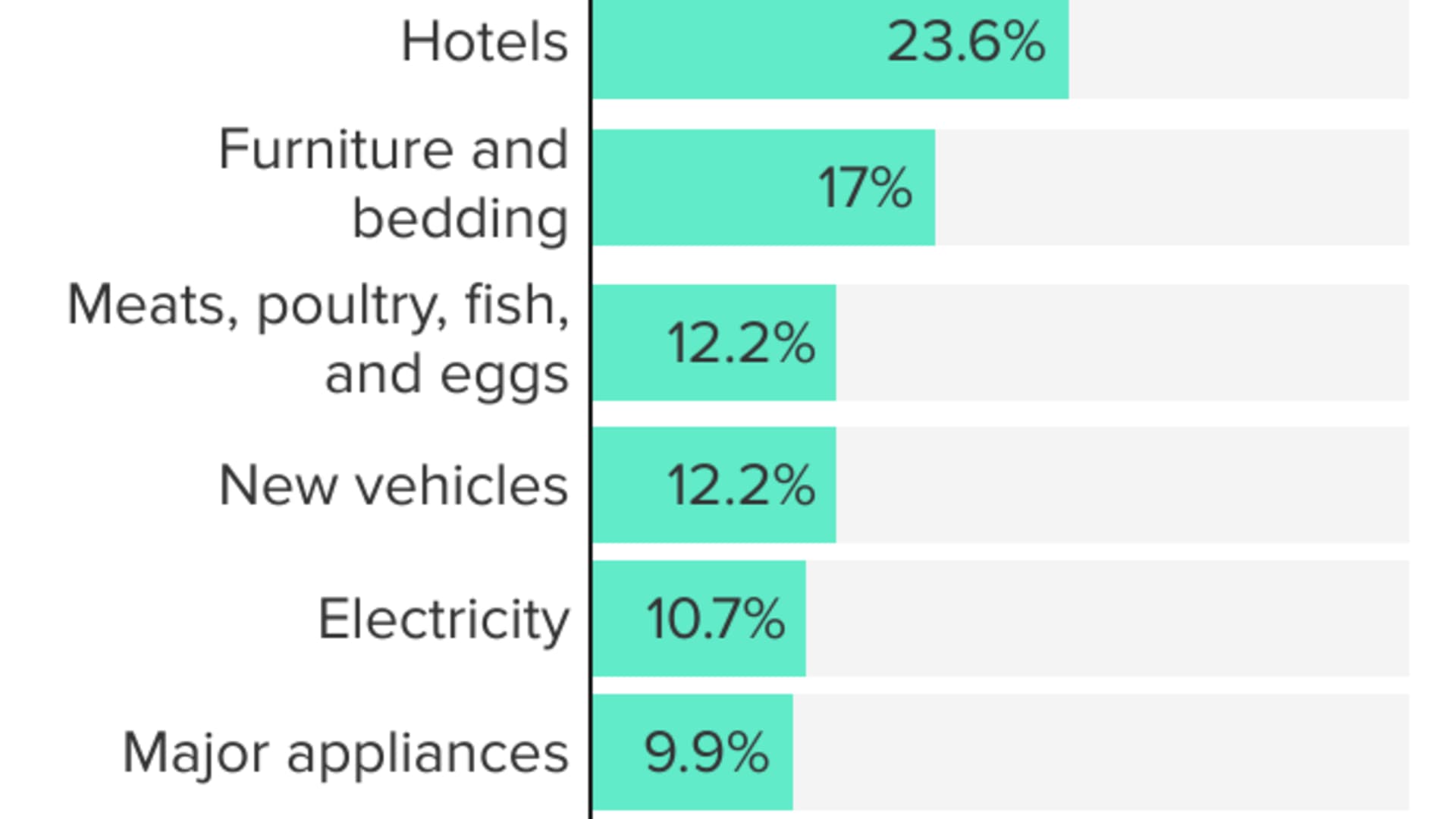

Here's how much prices rose for various items in the last year, according to data from the U.S. Labor Department:

When will inflation level off?

Money Report

No one knows for sure, but the Federal Reserve is expected to raise interest rates in March, when the Federal Open Market Committee is next scheduled to meet. An interest rate hike increases the cost of borrowing, and encourage consumers to spend less, which, in turn, decreases the rate of inflation.

However, since the rate of inflation was higher than expected in January, the Fed might pursue a more aggressive tact by announcing their first half-percentage-point increase since 2000, instead of a typical quarter-point move.

"The urgency facing the Fed is clear in this month's CPI release, as trends have continued higher and the fundamentals of housing costs, wage demands and supply chain disruptions show no signs of abating," says Kurt Rankin, an economist at The PNC Financial Services Group.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: Disney is hiring TikTok creators — you need to love theme parks, food and social media