This story is part of CNBC Make It's Millennial Money series, which profiles people across the U.S. and details how they earn, spend and save their money.

Roy Patterson stands in front of his bathroom mirror, explaining the benefits of Biologique Recherche Lotion P50, a cult-favorite product among skincare obsessives that runs over $100 for an 8.4 ounce bottle.

That's a hefty sum for a facial exfoliator, the 31-year-old IT manager acknowledges, but worth every penny. He picked it up last year while he was on a trip to Paris with his girlfriend, Shani Gardner. And he says it's made his skin noticeably smoother and brighter.

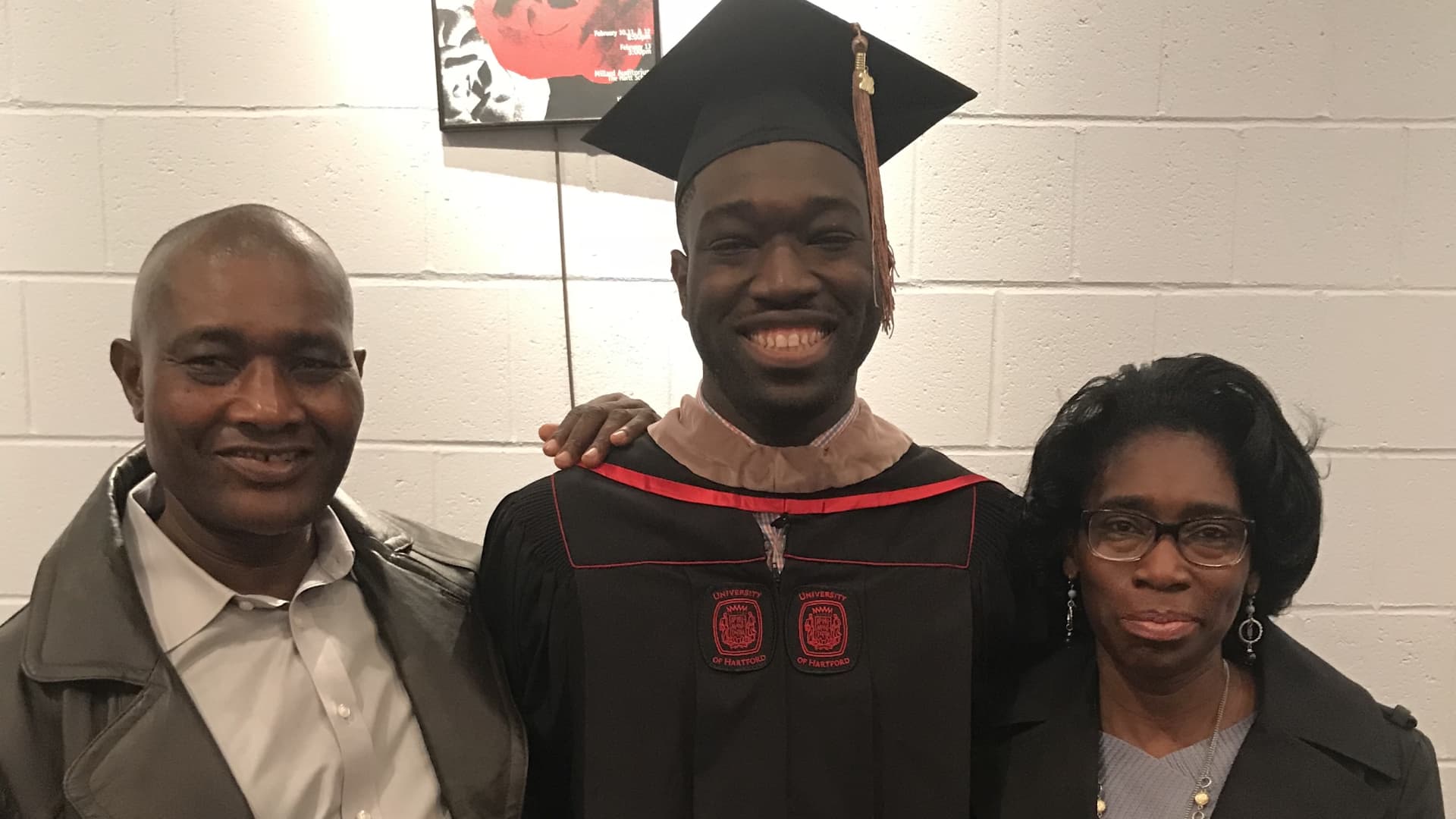

If it all sounds indulgent, Patterson agrees. But he argues he's earned a bit of pampering. Just two years ago, he saw little reason to buy skincare products at all, he tells CNBC Make It. At the time, he was still paying off over $55,000 in student loan debt from his time at Eastern Connecticut State University, and he wouldn't spend a dime more than he had to on anything, never mind splurging on non-essentials like French face lotions and transatlantic flights.

But Europe was a celebratory trip. Patterson managed to completely pay off his debt just before his 30th birthday, and after seven years of working his way up at the health insurer Cigna, he was promoted to a management role with a six-figure salary. Years of scrimping were finally paying off, and he wanted to treat himself.

"I hated feeling that I had this overbearing weight on my shoulders," says Patterson. "It was really stressing me out. Most days I barely slept because I really didn't understand how I was going to pay it off."

There was no silver bullet to pay off the loans, which his parents co-signed, he says. Instead, he lived ultra-frugally, throwing every extra dollar toward the debt each month. While he will earn close to $150,000 this year, he paid off his debt while earning between $61,000 to $90,000 per year.

Money Report

He was inspired by personal finance expert Suze Orman, and "The Suze Orman Show" became appointment television each week for him and his mother when he was still living with his parents in Connecticut.

Mother and son followed Orman's advice together, holding each other accountable to pay off debt — credit card and car bills for his mom, student loans for Patterson — and get the rest of their finances in order. While his parents provided a stable home for him and his siblings growing up, Patterson says, as immigrants from Jamaica they didn't understand the nuances of the American financial system. Watching Orman's show taught them how money works in the U.S.

"I told my mom, If you do it, I'm going to do it. And we made this pact," he says. "We would share our wins, we would share our successes. If we failed at something or we felt like we could do better, we shared that as well."

Using advice from Orman and Patterson's own internet research, he decided to use the snowball method of debt repayment: He paid off the loan with the lowest balance first, and then moved on to the next largest loan, and so on, until all seven federal loans and five private loans were paid off. He credits part of his success to Orman's no-nonsense attitude and advice, adding his reverence has become something of an inside joke. "My friends call me Mr. Orman," he says with a laugh.

He doesn't regret the years of cost-cutting now that he's debt free, although he occasionally wishes he hadn't made quite so many sacrifices. He skipped a family trip to Jamaica because he didn't want to buy a plane ticket, and he doesn't want to miss out on experiences like that any more. Some things, like vacations with his loved ones and, of course, the P50, are worth the expense.

"I worked with my mom, and the joy that she has in her life now, knowing that she's also debt free, makes me realize that what we did works," he says. "It allows us to live the life that we wanted to live."

Living and working in Philadelphia

At the time of filming, Patterson earned a base salary of around $118,000 per year managing a team of project managers at Cigna.

"I love the work that I do, especially in managing people, mentoring people and really getting to work on very cool and exciting projects," he says. "I feel really fulfilled."

A six-figure salary is a recent development, and Patterson is pleased with the life it affords him in Philadelphia, where he's lived since 2016. He and Gardner split the cost of a one-bedroom apartment in City Center, right across the street from the Philadelphia Museum of Art.

They love the neighborhood, where they can walk to restaurants and bars and much else of what the city has to offer without a car (Patterson sold his to save money when he was repaying his student loan debt). The couple also plays the Sims together for hours on end.

Patterson says Gardner is more frugal than he is. She's a social worker and makes less, though she still manages to save a good portion of each paycheck.

"I'm very cognizant of how we budget our money," he says. "I try to help her as much as I can, but I also know that she has to go through her own journey." Patterson pays a little more than 60% of the total rent and utilities, which the couple decided is a fair split, given their different incomes.

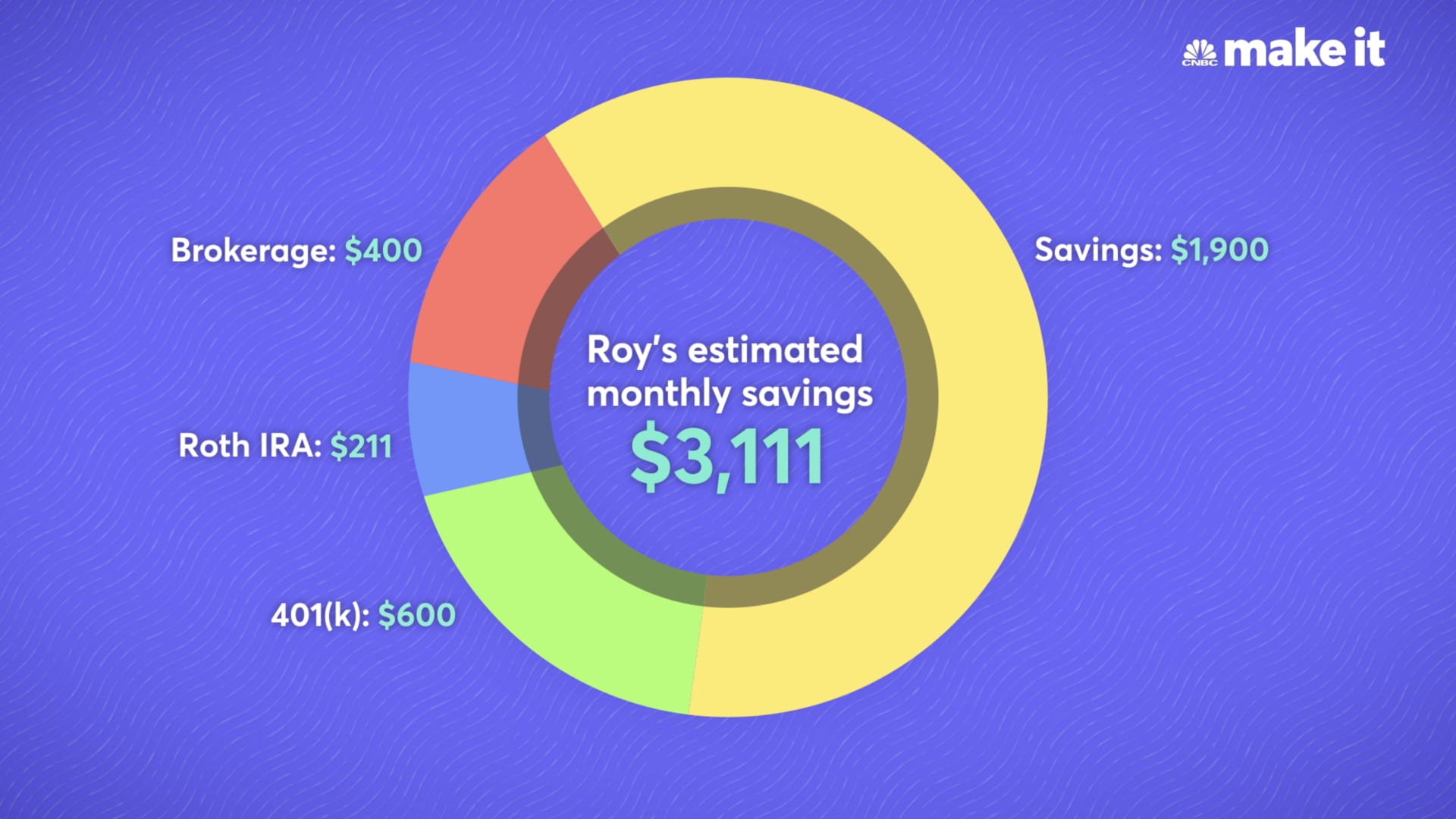

Here's Patterson's estimated monthly spending as of February 2020:

- Savings: $1,900

- Investments: $1,211 (401(k), Roth IRA and brokerage account contributions)

- Housing: $925 (for a one-bedroom apartment, split with his girlfriend)

- Food: $750 ($250 on groceries, $500 on eating out)

- Misc.: $630 (clothing for work, entertainment, haircuts, travel)

- Insurance: $172

- Subscriptions: $155 (Amazon Prime, Disney Plus, Hulu, Netflix, gym membership)

- Utilities: $132 (cable, electricity and WiFi,split with his girlfriend)

- Phone: $71

- Transportation: $70 (subway, ride-hailing services)

Since the coronavirus pandemic spread across the U.S., Patterson says he's lucky that his situation has not changed dramatically. He and Gardner are able to work from home, and as of writing, they are both employed. If anything, Patterson thinks he's saving money since he's not dining out — he estimates he now spends around $50 a week to split delivery with his girlfriend.

Future plans

Now that he's paid off all of his debt, Patterson is focused on saving for the future. "Words can't really explain how much freer that I feel now that I don't have any debt," he says.

He's investing over $1,200 per month for retirement, and close to $2,000 in his savings account, much of it earmarked for a move to New York City for his job.

He and Gardner plan to move over the summer; but with coronavirus disrupting so many plans, they are taking things day by day. His employer is covering some of his relocation costs, but Patterson has saved $10,000 to prepare for the increased cost of living. He is also saving for a rental property, which he still hopes to buy by the end of 2020 and prioritizing his brokerage account. He hopes to retire as early as possible.

"Now that I'm debt free, some of the goals that I have is to start really diversifying my portfolio," he says, "making sure that I can start getting enough dividends and interest to live off of that when I decide to retire."

Discipline pays off

CNBC Make It spoke to Ande Frazier, certified financial planner and founder of MyWorth, to comment on what Patterson is doing right with his money and where he could improve.

"Congratulations to Roy on being so focused on getting that student debt paid off," says Frazier. "I can see that he is disciplined and determined to reach a goal he has set for himself."

And those behaviors that he's learned — to be disciplined enough to pay off a huge amount of debt and save over $10,000 for his move — will help him reach the other goals he has set for himself.

"If Roy continues with this discipline, he will be in good shape for his future," she says.

Here's what Frazier recommends Patterson does next.

Create a 'liberty' fund

Frazier's top recommendation is for Roy to create a "liberty" fund of six months' worth of expenses. While he has $10,000 saved for his move, he'll be in a tough position if he spends that, since most of his assets are invested.

"More than just emergencies, a liberty fund gives Roy the freedom to make choices during times of challenge, opportunity or change, without compromising his financial future," says Frazier. "This is a fund that is liquid, accessible and unattached to the market."

She advises that this take precedence over investing more for retirement. "Once he has this saved up, he can then refocus on his long-term goals."

Plan for an early retirement

Patterson is already saving a lot, but Frazier says he needs to really do the math on how far his savings will get him in retirement, especially if he wants to retire early.

"Remember that retirement can last up to 30 to 35 years, and that's assuming you retire at the typical age of 65," she says, noting that he will need to have at least $3 million saved to replace a $120,000 income each year with a 4% withdrawal rate. "He could choose to have less saved and make a plan to spend down all of it, but since he doesn't know how long he will live, that is risky as he could run out of money in later years."

If he wants to retire early, he'll likely need more invested in his brokerage account, given that he would be hit with penalties and taxes for tapping his 401(k) plan before age 59 ½.

A brokerage account "allows him to take money without penalty if he needs it earlier, and he may be able to take advantage of lower capital gains rates, too," she says. "He should continue to use these accounts as he saves money for his future, but consider rebalancing them as needed to keep them diversified and matching his overall risk tolerance."

That said, all of his hard work has put Patterson in an enviable financial position.

"The good news is Roy is doing many things right, and with a little adjustment, he can be better prepared to handle life not only in the future but along the way," says Frazier.

Patterson hopes that his story will show other people with debt that they can pay it off and accomplish the rest of their financial goals.

"The most important thing that I learned about money is that money doesn't make who you are," he says. "Money brings out either the best or worst in what's already in you.

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment. We are especially interested in hearing from first-time homebuyers.

Don't miss: This 24-year-old first-generation American earns $230,000 per year working three jobs

Check out: The best credit cards of 2021 could earn you over $1,000 in 5 years