‘Catch-and-kill' to be described to jurors as testimony resumes in Trump's hush money trial

-

Man who attacked police after storming US Capitol with Confederate flag gets over 2 years in prison

A Kentucky man who stormed the U.S. Capitol while carrying a Confederate battle flag has been sentenced to more than two years in prison for pepper spraying two police officers in the face, temporaril... -

Biden sees a $35 price cap for insulin as a pivotal campaign issue. It's not that clear-cut

President Joe Biden often overstates what people who are eligible for the price cap for insulin paid previously.

-

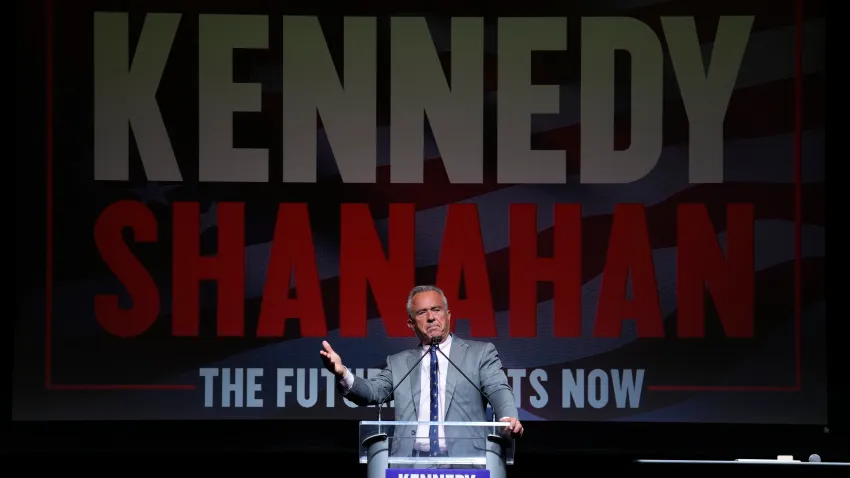

RFK Jr. candidacy hurts Trump more than Biden, NBC News poll finds

The latest national NBC News poll shows the third-party vote — and especially independent presidential candidate Robert F. Kennedy Jr. — cutting deeper into former President Donald Trump’s support tha... -

The House passes billions in aid for Ukraine and Israel after months of struggle. Next is the Senate

The House has approved a $95 billion package of foreign aid for Ukraine, Israel and other U.S. allies after months of turmoil on Capitol Hill.